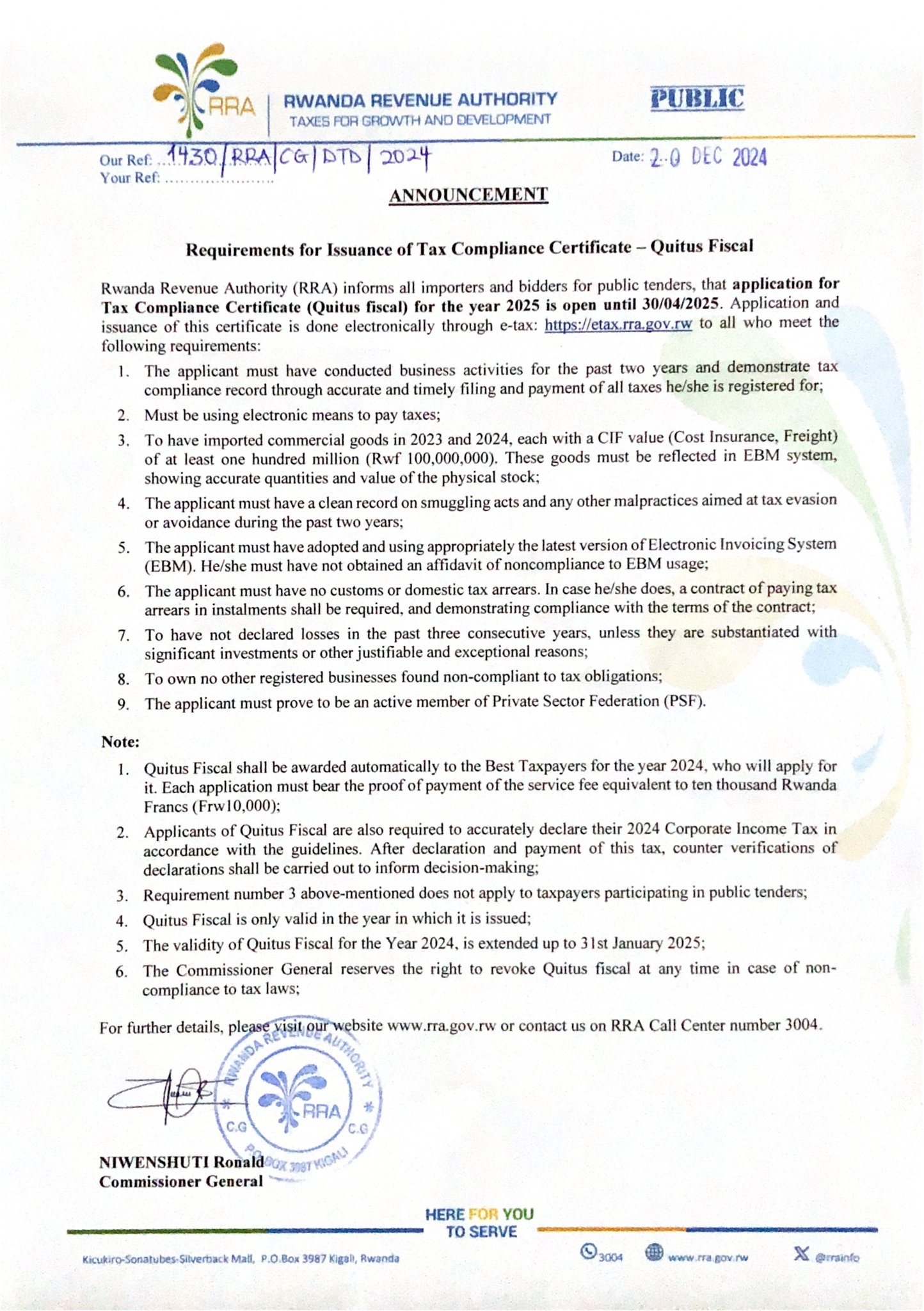

Rwanda Revenue Authority (RRA) has revamped Tax Compliance Certificate framework, also known locally as the Quitus Fiscal.

RRA announced the new requirements in a strategic push to enhance transparency, accountability, and competitiveness within the country’s business ecosystem.

The future of business in Rwanda is digital, transparent, and accountable. This move signals Rwanda’s dedication to modernizing its tax systems while attracting reputable investors and filtering out non-compliant operators.

At the heart of the new framework lies a robust threshold: businesses seeking certification must demonstrate a minimum of Rwf100 million in commercial imports for both 2023 and 2024. This ambitious criterion reflects Rwanda’s intent to solidify its status as a regional trade hub and a magnet for international commerce.

The revamped certification requirements also include:

•Mandatory Use of Electronic Invoicing Systems (EBM): Ensuring accuracy and transparency in transactions.

•Zero Tolerance for Smuggling and Tax Evasion: Strengthening compliance and accountability.

•Financial Health Standards: Businesses must avoid declaring consecutive losses.

•Private Sector Federation (PSF) Membership: Reinforcing collaboration within Rwanda’s private sector.

In a bid to reward top performers, the RRA announced that businesses recognized as “Best Taxpayers” in 2024 will receive automatic eligibility for the Quitus Fiscal, pending application and payment of a nominal Rwf10,000 fee. This incentive aims to promote exemplary tax compliance and encourage businesses to align with the nation’s standards.

“This isn’t just about collecting taxes,” explained a senior RRA official. “It’s about creating a business ecosystem capable of thriving on the global stage.” The new framework sets the tone: Rwanda is open for business, but only for those ready to embrace a culture of compliance and innovation.

Transition Period and Deadlines

To ensure a seamless shift, the RRA has extended the validity of 2024 certificates until January 31, 2025. Businesses have until April 30, 2025, to apply for the new certification via the RRA’s user-friendly e-tax portal (https://etax.rra.gov.rw).

Meanwhile, this initiative is yet another milestone in Rwanda’s remarkable journey from a post-conflict society to a modern economic powerhouse. By prioritizing transparency, digital transformation, and financial discipline, Rwanda is crafting a business environment that inspires investor confidence and fosters sustainable growth.

Businesses interested in aligning with this vision can access detailed guidelines on the RRA website or contact the RRA call center at 3004 for assistance.

For Rwanda, tax compliance is no longer just a statutory requirement—it is a cornerstone of its ambitious path toward becoming a global economic leader. The race is on for businesses to adapt, innovate, and seize the opportunities presented by this transformative era.